-

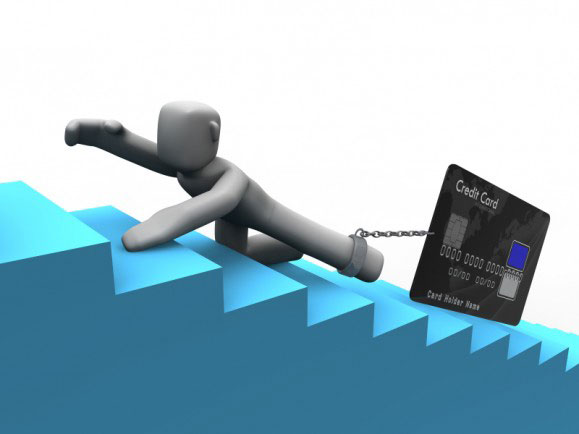

Are you using your credit card to fund your cash flow?

Are you sick of drowning in excessive credit card debt?

Have you recently reviewed your cash flow budget?

For any business, big or small, reliable cash flow is vital. You need the financial capacity to meet day-to-day operational costs.

We often find business owners using personal credit cards to cover business costs. This is an easy way to cover a temporary shortfall but if the balance is not cleared at the end of each month, it can be very expensive.

Best practice is:

– Prepare a cash flow budget to forecast your income, expenses and identify available cash

– Compare your actual cash situation to the forecast regularly and take action if required

– Arrange a reliable and ongoing source of cash flow finance if your budget identifies a cash shortage

As your broker, we can help you find a solution to better manage your cash flow. Options include an overdraft facility, line of credit, debtor finance and unsecured sources.

Recently, we have partnered with a leading provider of unsecured business cash flow finance. Our business partner provides a flexible, quick and easy alternative to assist with short and medium term finance solutions that can produce time to cash in 48 hours for most applications.

This process is quick, easy and can be completed from your desk.

Contact us today for an obligation free discussion about your business and how we can assist you!